How Much Should You Earn in Dubai to Buy Real Estate Worth 1 Million USD

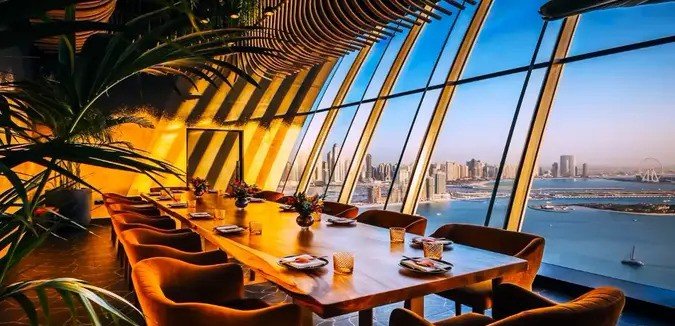

Dubai offers a lavish lifestyle & world class amenities. A unique blend of luxury & sophistication is on offer. But before you dive into the property market it is wide to understand the financial situation. You should know what it takes to afford such a prestigious investment.

Similar Articles

Ideal Salary Ranges in Dubai

Experts advise that a monthly salary between AED 31500 & AED 42000 to purchase a $1 million property in Dubai. This is if there are no existing financial commitments.

This salary range ensures that buyers can comfortably handle mortgage payments. Other related expenses can also cause financial strain. The above income enables you to navigate the landscape effectively.

Higher earnings can result in more favorable financing options from banks. The banks consider the income & also their credit score. The income guidelines help maintain a solid financial profile. Aspiring homeowners can navigate the financial requirements more effectively. This brings the dream of owning a luxurious property in Dubai within reach.

What Different Salary Brackets Can Afford in Dubai?

An applicant with a monthly salary of Dh50,000 can consider buying a property worth close to $1 million. These properties typically require a 20% down payment. You can also go for 80% bank finance.

Loan eligibility depends on factors such as profession & income. Factors like employment status, residential status, age, & existing financial obligations also matter. A UAE resident making a 20% down payment on a 25 year loan can op for monthly installment. These would be Dh15,333. A 25% down payment reduces the monthly installment to around Dh14,500 to Dh15,000.

The bottom line is a minimum monthly salary of Dh30,000 to Dh40,000 with no financial commitments is needed. Couples can combine their salaries & down payment to qualify for property ownership in this price range.

Financial Requirements for a $1M Property An Estimate!

Down Payment

The typicаl down payment ranges from 20% to 25%. It translates to approximately $200000 to $250000. The remaining balance can be financed through a mortgage.

Monthly Payments

Monthly mortgage payments can vary between AED 15225 & AED 16100. This is for a loan tenure of 25 years. A minimum monthly sаlary of AED 31,500 to AED 42,000 is required to manage payments easily. This is if there are no other financial commitments such as credit card debt or personal loans.

Property Types at $1M

Apartments

Dubai offers 3BR units in areas such as Dubai Creek Harbour & Dubai Hills Estate.

Townhouses

You can find 4BR townhouses in communities like Jumeirah Village Circle & Arabian Ranches. Damac Hills also has properties in this range.

Villas

4BR semi detached villas with larger square footage are available in Emaar South.

Other Options

You an choose properties un prime locations. These include Downtown Dubаi, Dubai Marina, Business Bay, & Jumeirah Beach Residence. You can choose from studio or 1-2BR apartments.

Market Trends & Growth

The UAE property market is booming. Government projects & economic growth have fueled the development. Dubai experienced a 17.85% increase in real estate transactions in the last. A total of 1.68 million deals were made with a value of AED 665.7 billion. This marked a 21% annual growth. Dubai remains more affordable for property investments compared to cities like London & New York. It offers high rental yields which make it an appealing destination for investors.

Additional Cost Considerations for Buyers

It is wise to budget for additional costs beyond the initial down payment. This ensures a smooth purchase process.

Dubai Land Department Fee

One of the primary additional expenses is the 4% fee. It is required by the Dubai Land Department. This fee is calculated based on the purchase price. It is essential for the official registration of the property.

Broker Fee

A 2% broker fee is typically charged. This fee covers the services of the broker. These include property search, negotiations, & paperwork.

Mortgage Registration Fees

There will be additional registration fees if you are financing your property through a mortgage. These fees are charged by the Dubai Land Department.

Ancillary Charges

Also factor in ancillary charges such as moving costs. Utility connection fees & potential service charges for property management should also be considered. These additional expenses can add up. So you should plan for tgem to avoid unexpected financial strain.

Who is Buying $1 Million Real Estate in Dubai?

Buyers of properties worth $1 million are usually high net worth individuals. Expatriates & business owners go for such properties. These buyers look for luxury amenities & prime locations. High-quality finishes and security features affect their buying decision.

Conclusion

Purchasing a $1 million property in Dubai requires careful financial planning. A solid income foundation is a must. A monthly salary between AED 31,500 & AED 42,000 is recommended by most experts.

Dubai has a dynamic real estate market. Diverse property options are available in every price range. Learning the financial requirements can help ensure a successful & sustainable investment.

_thumbnail_1756228078.jpeg)

_in_dubai_thumbnail_1749102836.jpeg)